maine tax rates compared to other states

The state sales tax rate in Maine is relatively low at 55 but there are no additional county or city rates collected on top of that. Vehicle Property Tax Rank Effective Income Tax Rate.

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

For example Hawaii has a top tax rate of 11 and 12 income brackets while Iowa has a top tax rate of 853 and nine income brackets.

. Maines percentage was 105 slightly more than the portion in. Maines statewide sales tax of 550 also ranks among the lowest in the country especially because there are no county or city sales taxes anywhere in the state. Social security is not taxed but pensions and retirement plans are both partially taxed.

Maine also has a corporate income tax that ranges from 350 percent to 893 percent. The income tax rates in maine range from 58 to 715. Maine Tax Rates Compared To Other States.

13 rows Tax Rates The following is a list of individual tax rates applied to property located in the unorganized territory. One tax collection area where New Hampshire outpaces its neighbor. Maines tax system ranks 33rd overall on our 2022 State Business Tax Climate Index.

Maine has a higher state sales tax than 808 of states. For the 2016 tax year the highest tax rate was lowered again to 715 where it has remained through at least the 2021 tax year. Hawaii also holds the second place spot for salesexcise tax collection per capita taking 2394 on average when you have a job in Hawaii.

Maine Tax Rates Compared To Other States. Income Tax Rank Effective Sales Excise Tax Rate. Table 2 compares state and local tax revenue by source and shows that while one form of taxation is high in a given state that same state might collect less money through other means of taxation.

Single status tax payers in most states have a relatively lower standard deduction and fewer family oriented credits available to reduce their income tax liability. Maine Middle class tax rate. And of course Washington DC.

Maine State Tax Rates. In some cases the local sales tax rate can be higher than the state sales tax rate. 531 2 2.

WalletHub placed Maine at 16th highest in the country in real estate taxes with a 136 real estate tax rate. The rates ranged from 0 to 795 for tax years beginning after December 31 2012 but before January 1 2016. The income tax rates are graduated with rates ranging from 58 to 715 for tax years beginning after 2015.

The Maine income tax has three tax brackets with a maximum marginal income tax of 715 as of 2022. 3rd Overall tax burden 1102 4th Property tax burden 480 15th Individual income tax burden 269. Grow Your Legal Practice.

Is not a state but it has its own income tax rate. 548 1 251 21 343 24 4. Hawaii and Maine Hawaii Top tax rate.

So when youre comparing sales tax rates from state to state look at both the combined state and local sales tax. Like many other states Maine uses millage rates to determine how much a homeowner owes in property taxes. A homeowner can expect to pay 2585 on a home with a 190000 median value.

To determine the residents with the biggest tax burdens WalletHub compared the 50 states across the three tax types of state tax burdens property taxes individual income taxes and sales and excise taxes as a share of total personal income in the state. Up to 20 cash back 2. Restaurants In Wildwood Nj Open Year Round.

Maine has a 550 percent state sales tax rate and does not levy any local sales taxes. Therefore 55 is the highest possible rate you can pay in the entire state of Maine. Hawaii and Maine Hawaii Top tax rate.

Seniors also benefit from a number of major sales tax exemptions. According to the Tax Foundation the five states with the highest average combined state and local sales tax rates are. Including federal taxes if you have a job in Maine your total marginal income tax rate will be 518 percent.

The taxes were ranked as a percentage of total personal income in each state. Maines tax was recently raised by a half a percent from 5 to 55. 52 rows Other states have a top tax rate but not all states have the same number of income brackets leading up to the top rate.

Effective Real-Estate Tax Rate. These rates apply to the tax bills that were mailed in August 2021 and due October 1 2021. How high are sales taxes in Maine.

Generally speaking a mill represents the amount a person owes per 1000 of assessed. The states top rate still ranks as one of the highest in the US. Franchise Tax Bd Cast Tax.

MAINE STATE 03901 550 MAINE STATE 03902 550 MAINE STATE 03903 550 MAINE STATE 03904 550 MAINE STATE 03905 550 MAINE STATE 03906 550 MAINE STATE 03907 550 MAINE STATE 03908 550 MAINE STATE 03909 550 MAINE STATE 03910 550 MAINE STATE 03911. Household annual state local taxes on median us. Filing as Single generally results in paying higher federal and Maine state income tax rates compared to the other four filing statuses.

Detailed Maine state income tax rates and brackets are available on this page. Maine has a General service provider and use tax which is for all intents and purposes very similar to the sales tax found in other states. When You Meet The Love Of Your Life Lyrics.

Maine generally imposes an income tax on all individuals that have Maine-source income. Sales Excise Tax Rank Effective Total State Local Tax Rates on Median US. Maine has a graduated individual income tax with rates ranging from 580 percent to 715 percent.

51 rows See how your states tax burden compares with other states. Heres how Maine ranked in those tax burden comparisons 1Highest 25Average. Real-Estate Tax Rank Effective Vehicle Property Tax Rate.

Chart 3 Oklahoma State And Local Tax Burden Vs Major Industry Fy 2015 Jpg Private Sector Industry Sectors Burden

Utah Sales Tax Small Business Guide Truic

Comparing The Real Cost Of Owning Property Across The United States Property Tax Real Estate Staging Denver Real Estate

The States Where People Are Burdened With The Highest Taxes Zippia

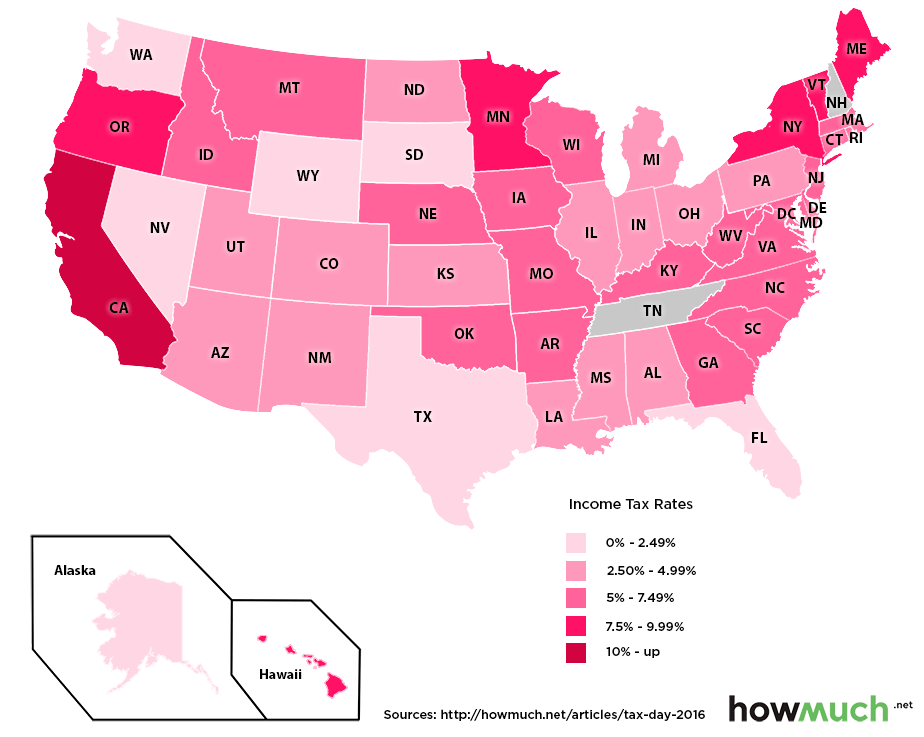

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

Report States With No Income Tax Get No Economic Boost Income Tax Income Charts And Graphs

States With Highest And Lowest Sales Tax Rates

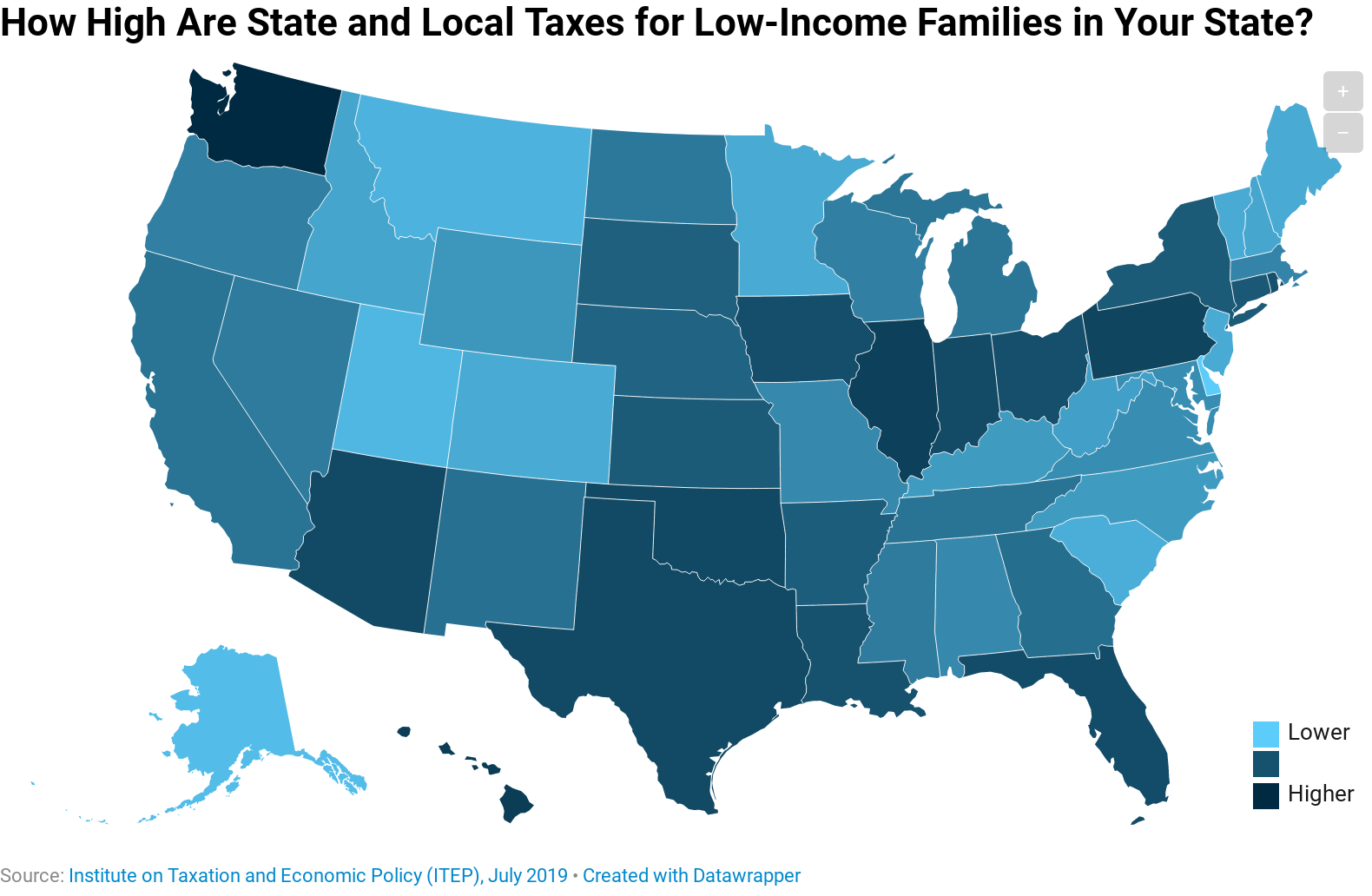

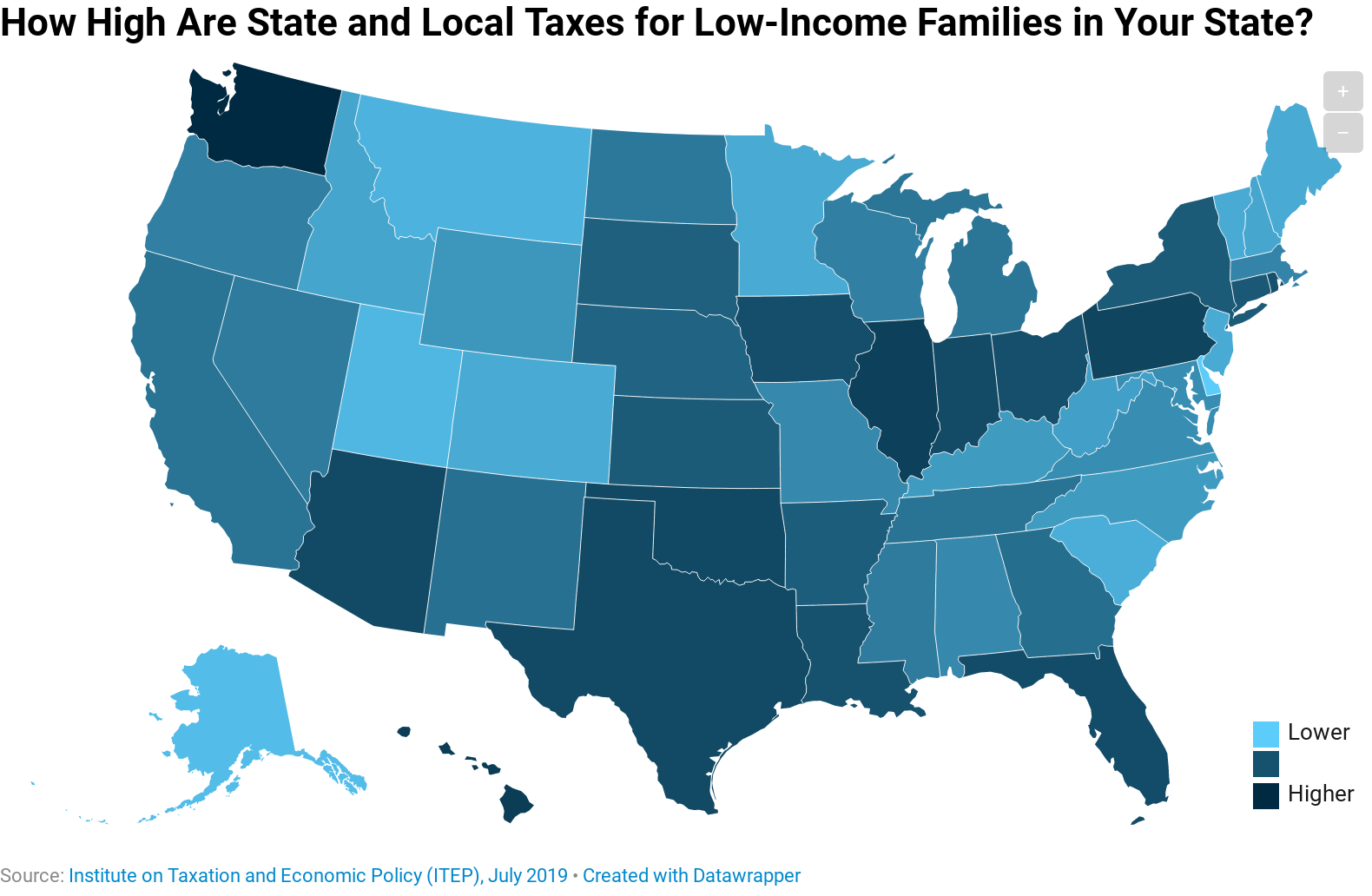

Which States Have The Highest Tax Rates For Low Income People Itep

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Sales Tax Expert Consultants Sales Tax Rates By State State And Local Rates

How High Are Capital Gains Taxes In Your State Tax Foundation

Chart 2 North Carolina State And Local Tax Burden By Type Of Tax Fy 1950 To 2016 Jpg Types Of Taxes Burden Tax

State Income Tax Rates Highest Lowest 2021 Changes

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Combined State And Local General Sales Tax Rates Download Table

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Connecticut State And Local Taxburden Manufacturing And Educational Services Burden Tax Connecticut